How to Plan Your Dream Trip to the Amalfi Coast and Tuscany Using Credit Card Points, According to a Money Expert

Visiting the Amalfi Coast and Tuscany felt like living in a dream. The Amalfi Coast’s beauty took my breath away. I saw dramatic cliffs, colorful houses, and the sparkling blue sea. In Positano, I watched boats bobbing in the water. The warm sun was on my face, and I felt so alive. Walking through narrow streets, I found cozy cafés with the smell of fresh espresso. Every meal was a treat—pizza by the shore, seafood pasta, and creamy gelato.

Then I traveled to Tuscany, where the hills were peaceful and covered in vineyards. Driving through the countryside, I saw olive trees and old farms. In Florence, the art and history amazed me. Seeing Michelangelo’s David in person was incredible. Each corner of the city seemed to have a story. Afternoons were spent in small villages, sipping wine and talking with friendly locals. They shared tales about their land and traditions.

This trip was more than just sightseeing. It was about feeling Italy’s heart and soul. From the bright shores of the Amalfi Coast to the warm charm of Tuscany, each place left a mark on me. Italy’s beauty, history, and warmth are unforgettable.

I spoke to a money expert about how to plan this dream trip. They gave me simple tips on using credit card points wisely. Here’s a step-by-step guide to help you plan an unforgettable Italian adventure without breaking the bank.

Great credit cards in the USA that offer travel points and rewards.

| Credit Card | Pros | Cons |

|---|---|---|

| Chase Sapphire Preferred® Card | – 5x points on travel through Chase – 3x points on dining – 2x points on all other travel – 60,000 bonus points after spending $4,000 in the first 3 months | $95 annual fee |

| American Express Gold Card | – 4x Membership Rewards points on dining worldwide – 3x points on flights booked directly with airlines or on AmexTravel.com – 2x on hotels and eligible purchases | Higher annual fee |

| Capital One Venture Rewards | – 2x miles on every purchase – Redeem miles for travel via Capital One Travel – 15+ airline and hotel partners for flexibility | $95 annual fee |

| Citi Premier® Card | – 3x points on travel, including gas – 2x points on dining and entertainment – 70,000 bonus points after spending $4,000 in the first 3 months | $95 annual fee |

| Wells Fargo Autograph Journey® | – 5x points on hotels – 4x points on airlines – 3x points on other travel and restaurants – 1x points on everything else – 60,000 bonus points after spending $4,000 in the first 3 months | $95 annual fee |

1. Choose the Best Credit Card for Travel Points

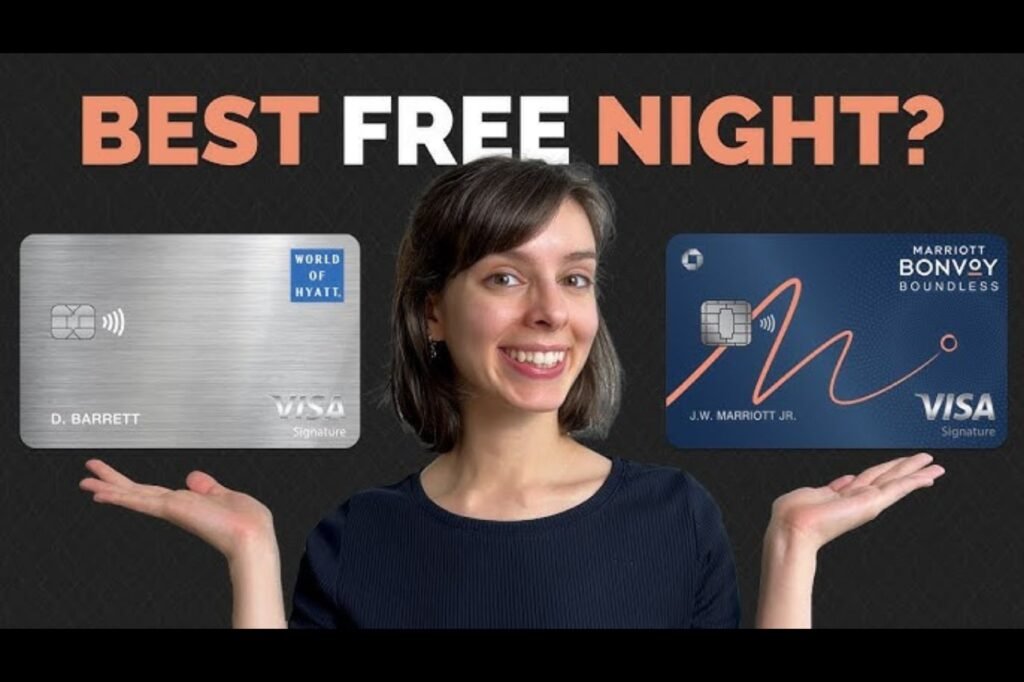

First, you need the right credit card. Travel credit cards come with rewards that can help you save on flights, hotels, and even meals. Cards like the Chase Sapphire Preferred or the American Express Gold Card offer bonus points on travel and dining.

When I started planning, I researched which cards had sign-up bonuses. Some cards give you thousands of points after spending a certain amount in the first few months. This bonus can be a huge help in getting free flights or hotel nights!

Tip: Look for a card that offers at least 50,000 points as a sign-up bonus. That could cover a one-way flight to Europe, or even a round trip if you find a good deal.

2. Decide When to Go for the Best Value

Timing is everything. The Amalfi Coast and Tuscany are most crowded in summer (June to August). During this time, flights and hotels are more expensive, and it can be hot. For a more affordable trip, consider visiting in spring (April to early June) or fall (September to October). The weather is still pleasant, and prices are lower.

I chose to go in May. The flowers were blooming, the weather was perfect, and I found good deals on both flights and accommodations.

Tip: Book your flights and hotels several months in advance. This helps you get the best value with your points.

3. Find the Right Flights Using Points

Flights to Italy can be expensive, especially during peak travel seasons. But using credit card points makes it possible to save big. If you have a flexible points card like Chase or Amex, you can transfer points to airline partners like United, Delta, or Air France. Sometimes, you’ll get better deals this way.

For my trip, I used Chase points to book a flight through United. I only paid a small fee for taxes. Another option is to use the credit card’s travel portal to book directly, which can sometimes offer deals.

Tip: Set up fare alerts if you’re looking for a specific flight. This way, you’ll get notified when the fare goes down.

4. Book Beautiful Accommodations with Points

The Amalfi Coast is famous for cliffside hotels with views of the Mediterranean Sea. But these rooms can be pricey. Using points for accommodations saved me hundreds of dollars. I chose a hotel in Positano, a town known for its colorful buildings and amazing views.

If you’re visiting Tuscany, you can also use points to book stays in Florence or the countryside. Many hotels in these areas are part of large chains like Marriott or Hilton. If you have points with these brands, you might be able to book a stay for free.

Tip: Check if your credit card points are transferable to hotel loyalty programs. Sometimes, transferring points to a hotel partner can give you better value than booking directly.

5. Plan for Transportation

Italy has a good train system, which makes it easy to travel between cities. I used points to book flights from the U.S. to Rome. From there, I took a train to Naples and then a ferry to the Amalfi Coast.

Renting a car in Tuscany is a great idea if you want to explore the countryside. Some credit cards offer car rental insurance as a benefit, which saved me from paying extra. However, keep in mind that driving in Italy can be challenging, especially on narrow roads.

Tip: Consider getting a credit card with no foreign transaction fees. This way, you can avoid extra charges when booking transportation and other services in Italy.

6. Enjoy Amazing Meals Without Spending a Fortune

Italian food is an experience in itself! Every meal felt like a treat. I used points from my Amex Gold Card for meals because it gives extra points for dining. From pizza in Naples to pasta in Tuscany, I enjoyed some of the best food of my life.

You don’t need to eat at fancy restaurants every time. Some of my favorite meals were from small trattorias and local markets. Plus, using points for food purchases kept me within my budget.

Tip: If your card gives extra points for dining, use it often for meals. It’s a great way to earn more points while enjoying local food.

7. Explore Attractions with Free or Discounted Tickets

There’s so much to see in the Amalfi Coast and Tuscany! Many famous sites, like Pompeii near the Amalfi Coast or the Uffizi Gallery in Florence, offer discounted or free admission on certain days. I used my points to cover admission fees for some places, which saved me money.

For other experiences, like wine tasting in Tuscany or boat tours along the Amalfi Coast, I booked in advance and sometimes used points if possible. It felt amazing to experience so much without spending a lot.

Tip: Check for free museum days or discount options. This is especially useful for popular places where tickets can be pricey.

8. Use Travel Insurance Benefits

Some credit cards include travel insurance, which covers you in case of trip delays or cancellations. My flight was delayed on the way back, but my card’s insurance covered the extra costs. This was a big help and gave me peace of mind during the trip.

Tip: Before you leave, check your card’s travel benefits. Knowing what’s covered can save you stress and money if things go wrong.

9. Keep Track of Your Points and Spending

It’s easy to get caught up in spending points, but keeping track is important. I used an app to see how many points I had left and how much each part of the trip was costing me. This helped me stay on budget and know when I needed to switch to using cash.

Tip: Use a budgeting app or spreadsheet to plan your expenses. This way, you’ll know exactly what you’re spending and won’t run out of points too soon.

Conclusion

Your Dream Trip Awaits!

Planning a trip to Italy with credit card points was a bit of a challenge at first. But once I figured out the steps, it became easier. Visiting the Amalfi Coast and Tuscany was one of the most beautiful experiences of my life. The best part? I didn’t have to break the bank to do it!

With a little planning, you can make your dream trip to Italy come true. Get a good travel credit card, keep track of your points, and book early. Soon, you’ll be sipping coffee on the Amalfi Coast or exploring a vineyard in Tuscany. Enjoy every moment of your journey—it’s worth all the planning!

FAQs

Q1: How do I earn travel points with a credit card?

You can earn points by making purchases with a rewards credit card. Some cards give more points for certain categories like dining, travel, or groceries. You may also get a welcome bonus when you first sign up.

Q2: Which type of credit card is best for earning travel points?

Travel rewards cards, like those offered by airlines, hotels, or major banks, often provide the best options. They let you earn points on daily purchases and offer perks like airport lounge access, travel insurance, and no foreign transaction fees.

Q3: How do I redeem points for travel?

Points can be redeemed through the credit card’s travel portal, transferred to airline or hotel loyalty programs, or used to book flights, hotels, car rentals, and more. You may also be able to redeem points for statement credits or gift cards.

Q4: Can I use points to cover all my travel expenses?

Often, yes! You can use points to cover flights, hotels, and sometimes even travel fees like baggage. However, additional expenses like meals and activities may not be covered unless your card allows point redemption for these purchases.

Q5: How many points do I need for a free flight or hotel stay?

The number of points varies by airline, hotel, and destination. A domestic flight might require around 15,000-30,000 points, while international flights or luxury hotels can cost more. Check your card’s travel portal for specific redemption options.

Q6: Can I combine points from multiple credit cards?

This depends on the cards and programs. Some banks allow points to be pooled within their programs or transferred to partner airlines and hotels, but not all do. Be sure to check your card’s rules.